Blockchain Surveillance Firm Chainalysis Raises $100 Million, Company’s Valuation Now $4.2 Billion – Blockchain Bitcoin News

The blockchain intelligence and surveillance firm Chainalysis announced the company has raised $100 million in Series E funding from investors such as Coatue, Benchmark, Accel, Addition, Dragoneer, Sequoia Heritage, and SVB Capital. The financing brings the company’s valuation to $4.2 billion and it aims to expand its resources and deepen data to cover more cryptocurrencies and focus on use cases like decentralized finance (defi).

Chainalysis Raises $100 Million, Blockchain Intelligence Firm’s Valuation Now Over $4 Billion

The blockchain Satoshi designed is a transparent ledger and transactions can be traced all the way back to the genesis block. This doesn’t necessarily mean, however, that a person can pinpoint with accuracy the identity of the individual or organization behind a cryptocurrency transaction.

Nevertheless, this data does help an investigator get closer to that answer. In Bitcoin’s early days, blockchain surveillance was mostly nonexistent, but a few years after the network effect gathered momentum it became much more prevalent.

There are now over two dozen blockchain intelligence and surveillance firms and over the years these companies have upped the stakes by monitoring dozens of blockchains besides Bitcoin. They have also raised millions of dollars from investors and government contracts.

On June 24, the firm Chainalysis revealed it had raised $100 million from investors and it aims to expand operations a great deal. Chainalysis launched in 2013 and the company provides blockchain data to governments, institutions, and exchanges in over 60 countries. The company’s $100 million raise bumps Chainalysis up to a $4.2 billion valuation. The Series E funding round was led by Coatue.

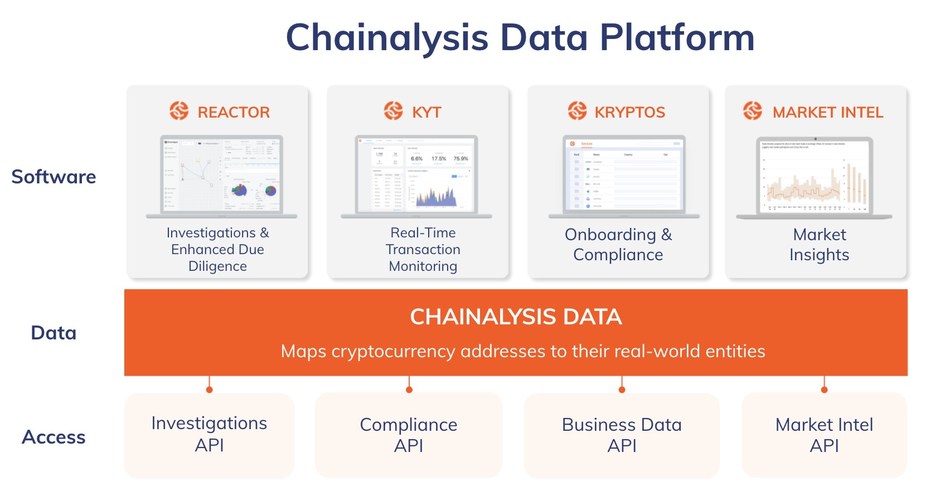

The Series E follows the $100 million Series D round the company raised in March 2021, and the funds will be used to expand services across the board. Three expansion concentrations are mentioned in the announcement which include deepening data. This would entail monitoring more cryptocurrencies and a focus on defi. Software is next on the list as Chainalysis aims to create software solutions for both the public and private sector.

Lastly, Chainalysis said it would provide more access via the use of APIs so “government agencies, financial institutions, and cryptocurrency exchanges” can leverage the firm’s data. The company has competition from the likes of well-known blockchain intelligence firms like Ciphertrace and Elliptic.

Other firms involved in the analytics and blockchain monitoring field include organizations like Sixgill, Tibco, Credits, Crystal Blockchain, Dune analytics, Madana, Bitrank, Ocyan, Alethio, Bison Trails, Blockpit, Blockmonitor, Bloxy, Postchain, and Scoreshain. Chainalysis’s Series D and E rounds bring the total amount raised by the firm to $365 million.

Blockchain analysis has been big business all across the globe and governments and law enforcement agencies have paid big money for these services. Between Chainalysis and Ciphertrace alone, it was estimated that in 2019 more than 80% of the cryptocurrencies in existence were tracked by blockchain surveillance.

What do you think about the blockchain surveillance firm Chainalysis raising $100 million? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.