How Plasma Finance Is Bringing DeFi to the Masses

The explosion of innovation in decentralized finance (DeFi) has come at a price. The growing complexity of many DeFi products presents a barrier to broader mainstream adoption and thus a danger to the sectors’ continued growth, Ilia Maksimenka, founder and CEO of protocol aggregator Plasma Finance (PPAY), told Decrypt.

Since 2020’s “DeFi Summer,” peer-to-peer financial services, such as yield farming and lending protocols on Ethereum and other blockchain platforms, have ensnared users—who simply compared the aggregated percentage yields (APYs) with those of regular finance service providers and never looked back. Today, the DeFi sector is worth a cool $270 billion.

But despite recent interest in DeFi from brands and banks, it remains a niche sector—an issue Plasma Finance is addressing head on. Maksimenka explained how the platform achieves a simplified and streamlined user experience through aggregating DeFi protocols while catering to seasoned users with analytics tools and features that securely combine the best of the traditional and decentralized finance worlds.

Familiarity for new users

Maksimenka firmly believes that DeFi platforms must compete with banks, exchanges, and the traditional financial services that people use every day. These services are easy to use, and DeFi appears super-complicated in comparison—“that’s the first problem that we’re trying to solve.”

Research demonstrates that users benefit from familiarity, which they find within established interface models, such as those used in traditional financial services. Most people want an experience that’s like using an iPhone; instead, those new to DeFi find it difficult to understand and are afraid of losing their money, says Maksimenka.

Hence, Plasma Finance onboards users “very softly,” with a step-by-step approach, beginning with downloading a wallet, and connecting a source of funding in order to access the DeFi ecosystem, he explained. Once those steps are complete, they can access the full DeFi experience on one platform, including top DeFi protocols YFI, Curve, Uniswap, and PancakeSwap, and several dozen crypto assets. So, instead of having to research 100 different platforms and protocols, everything users need is in one place.

Crucially, Plasma Finance provides fiat on-ramps for buying tokens in almost every country in the world. In parts of Africa and Southeast Asia, where users may not have access to the likes of Mastercard or Visa, the platform allows them to use bank wires instead, as well as locally available e-wallets.

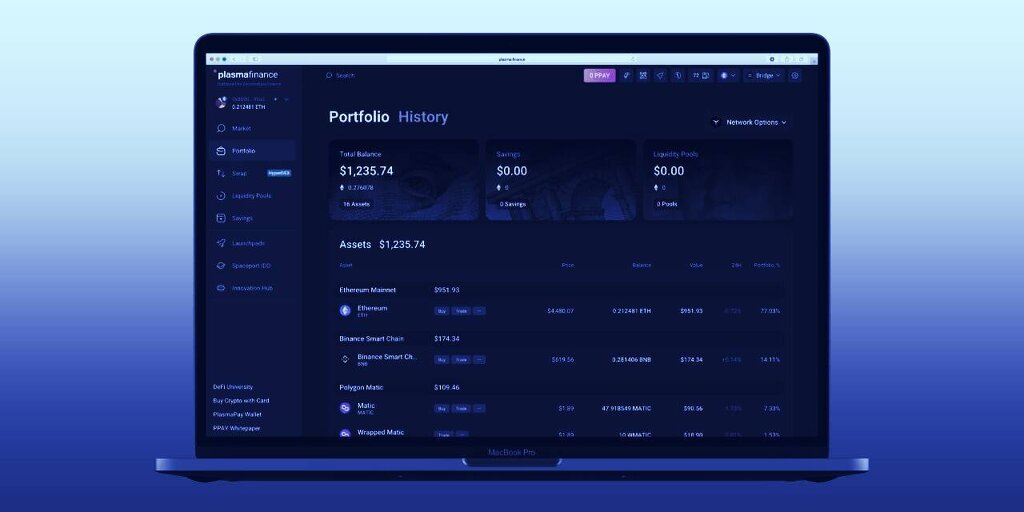

Other key features include a portfolio management tool, access to liquidity pools, help with lending and borrowing, an aggregate decentralized exchange and swap platforms.

And notably, the team also performs security audits on projects and tags risky ones accordingly.

Sophisticated tools for seasoned traders

The platform strives to be equally attractive to professional DeFi users, such as asset managers, traders, and liquidity farmers.

It has its own DEX or automated market maker (AMM) called PlasmaSwap, as well as HyperDEX, its aggregator protocol, which aggregates around 50 different DEXs across three chains—Ethereum, Polygon, and Binance Smart Chain (BSC). Thus it finds the best prices and lowest fees, in order to achieve the highest possible return on investments.

In addition, there’s a “zero gas fees” option and users have the option of using limit orders.

Then there’s Plasma’s token launchpad, SpacePort, which has built-in investor protection features and presents a “technical solution that has all that projects need for crowdfunding, like a token sale, or to launch their personal DEXs and build a vesting schedule for their investors,” said Maksimenka. He contends that it’s the most decentralized solution of its kind out there.

Soon, he added, Plasma Finance is launching its margin protocol, which means users will be able to borrow assets to trade with a 5x margin on DEXs—across different blockchains.

DeFi in 2021: fractionalized and niche

A 2020 survey by computation platform ARPA estimated that only one percent of crypto owners use DeFi. Since then, the sector has enjoyed an outpouring of innovation. But, despite all the hype surrounding it, DeFi remains a niche corner of the larger cryptocurrency market.

The sector is fractionalized, according to Maksimenka; up to now, many teams have focused on innovation at the expense of making their products user-friendly. Thus good user interfaces (UIs) and market standards are sorely lacking, and that’s a problem for adoption.

In recent months, major players in the legacy finance world have begun exploring DeFi; Bank of America recently reported that DeFi presents “the most innovation” in the crypto space, while Goldman Sachs has filed for a DeFi ETF that tracks decentralized finance firms. According to a Citi exec, the bank’s institutional investor clients are expressing growing interest in the DeFi space—but they expect considerable hand-holding.

In the coming years, traditional finance will not be able to ignore the DeFi industry, with its smarter, more efficient processes and the high yields they achieve—compared to the paltry rates currently on offer with traditional finance.

“Banks have to use DeFi tools for increasing the APY and increasing their profits and profits for their customers,” Maksimenka contends.

He’s convinced that the biggest protocols will become even bigger, and that’s ideal for Plasma Finance, which wants to be the shop window where users can view all the myriad DeFi services on offer—an Amazon for a DeFi world.

Sponsored post by Plasma Finance

This sponsored article was created by Decrypt Studio. Learn More about partnering with Decrypt Studio.