US National Debt Crisis: Impact and Prevention

As the bedrock of the global economy, the US national debt consistently stands at the forefront of economic discussions. What if the unthinkable happened and the US defaulted on its debt?

Let’s delve into the potential aftermath, scrutinizing domestic and international economic and social ramifications, and assessing the probabilities and risk mitigation strategies of a US default.

The Domino Effect: Global Economic Havoc

A US default could set off a chain reaction, wreaking havoc on financial markets worldwide. With the US dollar as the global reserve currency, a default would likely lead to its devaluation. Consequently, international trade could face severe disruptions, as trust in the dollar falters and countries scramble to find alternative trading currencies.

Investors, fearing a collapse of the US bond market, might panic and pull funds from other markets, feeding the crisis. The knock-on effects could be felt across the globe, as economies dependent on the US dollar see a sudden drop in demand for their goods and services.

The 2008 financial crisis, which rippled across the world, pales in comparison to the potential devastation of a US default.

Social Implications of the US National Debt

The repercussions wouldn’t stop at the global economy; US citizens would feel the brunt too. A default could spur unemployment and inflation, eroding purchasing power and job security. For instance, businesses might cut back on hiring or downsize their workforce, while consumers would struggle to keep up with rising costs.

Moreover, pared-down social services might hit vulnerable populations the hardest, widening the gap between the haves and the have-nots. Core programs, like food assistance or healthcare, could face severe cuts, leaving millions of Americans without a safety net.

The strain on the US economy would be immense, as countless families grappled with the aftermath of a default.

Preventive Measures

To stave off a US default, several strategies and policy changes are in order. Fiscal responsibility should be a priority, with prudent government spending and tax reform. Reining in deficits, closing tax loopholes, and streamlining bureaucracy can help bolster the nation’s finances.

Monetary policy reform is also essential, reining in excessive money printing and interest rate manipulation. The Federal Reserve should be transparent and cautious in its approach, to maintain stability in the financial system. Additionally, fostering international cooperation can play a role in addressing debt concerns and building a more resilient global economy.

In light of the current debt-ceiling standoff, President Joe Biden has considered invoking the 14th Amendment to circumvent the debt ceiling and avoid a government default without action from Congress. However, he expressed concern about inviting litigation that could block this risky strategy.

The 14th Amendment, specifically Section 4, states that the “validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned.”

Some constitutional experts argue that the debt ceiling, which sets a cap on the amount the US can borrow, violates this provision.

Challenging the Legality of the Debt

According to this theory, the Biden administration could challenge the legality of the debt limit by having the Treasury continue to issue new debt to fulfill its financial obligations, without seeking congressional approval to raise the debt limit.

Biden has alluded to the views of Laurence Tribe, a professor emeritus at Harvard Law School and constitutional law scholar, who endorsed the 14th Amendment theory after initially dismissing it in 2011 when President Barack Obama faced the risk of default. In a New York Times op-ed, Tribe argued that the issue isn’t the president’s authority to “tear up” the debt limit statute, but whether Congress can impose an arbitrary dollar limit to force presidential compliance.

Tribe argues that the answer is no.

By exploring options such as invoking the 14th Amendment or implementing policy changes, the US government can work towards averting a national debt crisis. However, these strategies must be carefully weighed against potential legal challenges and long-term consequences.

A Bitcoin Surge?

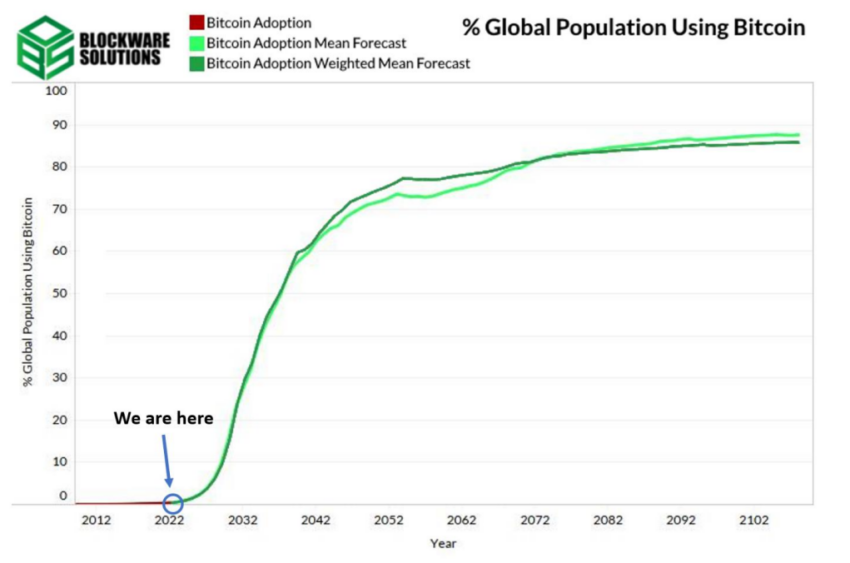

Interestingly, a US default might ignite a surge in Bitcoin and other cryptocurrencies. As traditional financial systems falter, people may flock to digital currencies to hedge against inflation and economic uncertainty. In a post-default world, cryptocurrencies could emerge as alternative stores of value, upending the status quo and reshaping global finance.

Countries like Venezuela and Zimbabwe, plagued by hyperinflation, have seen citizens turn to cryptocurrencies for financial stability.

In Venezuela, for example, the local currency, the Bolivar, has become virtually worthless, leading people to adopt Bitcoin for everyday transactions, such as buying groceries or paying bills. Businesses, too, have started accepting cryptocurrencies to bypass currency controls and maintain their operations.

A US default could prompt a similar shift, as individuals and businesses worldwide seek refuge in decentralized financial systems less vulnerable to traditional economic shocks. Financial institutions might explore integrating digital assets into their offerings.

While governments could examine the feasibility of central bank digital currencies (CBDCs) to maintain financial stability and facilitate cross-border transactions. In this context, the rise of DeFi platforms could provide alternative investment opportunities and reshape the global financial ecosystem.

Bracing for the Storm

A US national debt crisis looms large, threatening far-reaching consequences for the global economy and society at large. By addressing these risks through strategic measures, such as invoking the 14th Amendment and embracing alternative financial solutions like Bitcoin and other cryptocurrencies, the US may yet weather the storm and ensure a more stable future.

Time is of the essence, and the world is closely observing the situation. Policymakers must take decisive action to implement solutions that protect the US economy and the global financial system.

Amid potential turmoil, embracing innovative strategies like digital currencies and decentralized finance may provide a safety net. Fostering a robust, inclusive, and adaptive global economy.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.