$10K Price Is Not A Negative

Bloomberg analyst Mike McGlone points out that the link between Bitcoin’s price and stock prices are now the strongest it’s ever been. He’s also skeptical about Bitcoin’s rapid move into the mainstream.

Bitcoin May Be Nearing A Ceiling

On August 29, in a post on X (formerly Twitter), Bloomberg analyst Mike McGlone elaborates how assets prone to vulnerability, such as Bitcoin, can experience price declines once the masses flock to invest:

“The lessons of high-performing, widely hyped assets show price reversion may be the greater risk once the masses jump on board.”

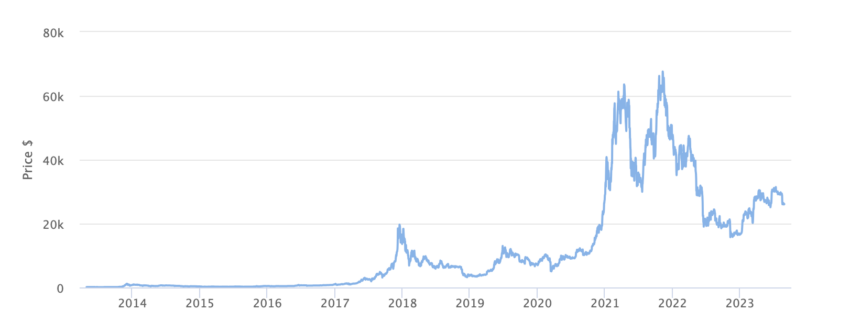

McGlone further points out how a $1 investment in Bitcoin in 2011 grew significantly in just 12 years, compared to Amazon’s return on investment over a period roughly twice as long.

“Up 26,000x in 12 years since first trading at $1 in 2011,Bitcoin compares with 130% for Amazon on a similar measure, but that took about 25 years,” he stated.

He contrasts Bitcoin’s movements to those of Amazon stock, noting that both assets have fallen below end-of-2020 levels:

“Bitcoin at about $26,000 on Aug. 28 is slightly below the end of 2020, similar to Amazon.com, with performance implications.” At the time of publication, Bitcoin’s price is $26,066.

Speculation Surrounding Bitcoin’s Price Intensifies

Several analysts have been heavily speculating over Bitcoin’s price in recent times.

Two prominent analysts, who go by the usernames Doctor Profit and Inmortal on X, predict a price dip to $23,500.

Doctor Profit attributes this to September historically being the worst month for Bitcoin, while Inmortal optimistically predicts it will be the last dip for BTC.

Meanwhile, in a recent interview with BeInCrypto, StormGain exchange crypto expert Dmitry Noskov predicted that Bitcoin’s price could exceed $30,000 by year-end.

McGlone is known for spotting unique trends with Bitcoin against other commodities.

On August 24, he pointed out that Bitcoin’s behavior mirrors the stock markets movements in the 1930s. This period is better known as the “great depression.”

In more recent news, JPMorgan reported that the recent selloffs in crypto assets are “largely behind us.” The research points to an increase in activity on the Bitcoin Futures market as a positive indication.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.