Following Rally, Bitcoin and Ethereum Face Resistance

Key Takeaways

Bitcoin and Ethereum have surged by over 28% over the past two weeks.

Both assets appear to be struggling to break through their 200-day moving averages.

Meanwhile, sell signals are starting to appear.

Share this article

The top two cryptocurrencies, Bitcoin and Ethereum, are consolidating below a stiff resistance level. A steep correction could be on the horizon.

Bitcoin, Ethereum Struggle to Break Out

Bitcoin and Ethereum have remained stagnant over the past few days even as lower cap assets rally.

The top two crypto assets have shown a strong correlation coefficient over the past two weeks. They have largely surged in tandem, gaining more than 28% in market value. However, both Bitcoin and Ethereum appear to have reached a critical resistance while sell signals are beginning to surface.

Bitcoin has been trying to break the 200-day moving average since Mar. 28, but has been unsuccessful. Although resistance tends to weaken over time, the trading volume appears to be fading around the current price level. The lack of buying pressure could lead to a rejection for Bitcoin to collect liquidity before advancing further.

The Tom DeMark (TD) Sequential Indicator adds credence to the short-term pessimistic outlook as it is currently presenting a sell signal on Bitcoin’s daily chart. A spike in profit-taking could validate the bearish formation, resulting in a one to four daily candlesticks correction. Under such circumstances, Bitcoin could drop to the demand zone between $43,760 and $41,460.

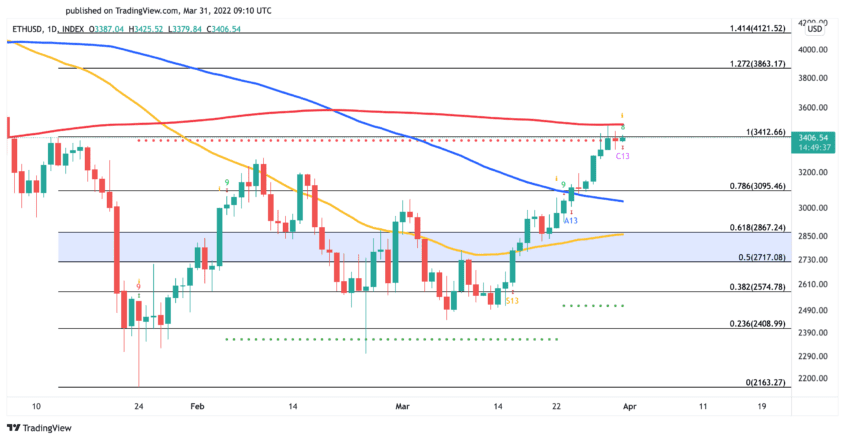

Ethereum’s uptrend also appears to have been halted by the 200-day moving average at $3,500. As Ethereum continues to trade below this crucial resistance level, the chance of a brief correction increases. Moreover, the TD Sequential Indicator is anticipating a bearish scenario.

The popular indicator has flashed a combo 13 candlestick on Ethereum’s daily chart, which can be considered a sell signal. If sell orders increase around the current price levels, Ethereum could drop to $2,870 or $2,720 before attempting to reclaim the 200-day moving average.

While Bitcoin and Ethereum appear to have encountered stiff resistance, some analysts believe that consolidation is suitable for future price growth. It’s worth noting that a daily candlestick close above the 200-day moving average could invalidate the short-term pessimistic outlook. If Bitcoin breaches the 200-day moving average, it could surge to $5,200. Ethereum, meanwhile, has a shot at $3,900 if it can break through.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

NFT Express: Your on-ramp to the world of NFTs

At Tatum, we’ve already made it super easy to create your own NFTs on multiple blockchains without having to learn Solidity or create your own smart contracts. Anyone can deploy…

MicroStrategy Borrows Against Bitcoin to Buy More Bitcoin

MicroStrategy arm MacroStrategy used a portion of the Bitcoin held in its reserves as collateral for the loan. MicroStrategy Announces Bitcoin Buy After accumulating some 124,000 Bitcoin, MicroStrategy is now…

Bitcoin’s Network Activity Is Soaring. What Comes Next?

Several on-chain metrics suggest that Bitcoin is gaining strength for a significant bullish impulse. Still, the top crypto has a big hurdle to overcome first. Bitcoin On-Chain Metrics Pick Up…

Opinion: 2022 Is Ethereum’s Biggest Year Yet

With the Merge to Proof-of-Stake on the horizon, 2022 is a crucial year for Ethereum. Ethereum Prepares for the Merge This time last year, as the big bull run was…