Grayscale Keeps Selling as Bitcoin Prices Lose $40K Again

Crypto markets have been rattled by days of Bitcoin offloading by the industry’s largest digital asset manager, Grayscale. Bitcoin continues to fall below $40,000, but much of the Grayscale outflow has been scooped up by other fund managers, so why are traders selling their coins?

Grayscale has been selling Bitcoin since US regulators approved spot BTC exchange-traded funds on January 11.

Grayscale Bitcoin ETF Share Selling Continues

Since it was permitted to convert its GBTC fund into a spot Bitcoin ETF on January 11, the firm has seen more than $3.3 billion in outflows. Additionally, it has been depositing large amounts of Bitcoin into Coinbase in preparation for further sales.

The reason for the Grayscale exodus is largely due to investors rebalancing their portfolios and entering funds with lower fees for better returns.

On January 24, CC15Capital, which has been posting updates on Bitcoin ETF holdings, said:

“Stop panic-selling your Bitcoin just because you see panic-inducing tweets about GBTC coins being sent to Coinbase every morning.”

It added that all Bitcoin sold by Grayscale so far has been scooped up by the other (lower-fee) ETFs.

BlackRock and Fidelity have been the biggest buyers of Bitcoin, with 39,925 and 34,127 BTC held, respectively, as of January 22. However, Grayscale has offloaded 82,525 BTC in the same period.

Read more: What Is a Bitcoin ETF?

Nevertheless, the total aggregate amount of BTC bought by the newly launched spot ETFs, not including Grayscale, remains a positive figure at 25,938 coins, according to CC15Capital.

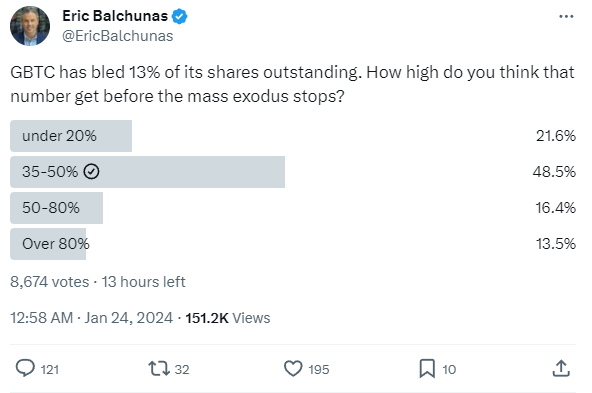

On January 24, ETF analyst Eric Balchunas held a poll to gauge when people think Grayscale will stop selling:

“GBTC has bled 13% of its shares outstanding. How high do you think that number gets before the mass exodus stops?”

Nearly half of the respondents voted for the 35%-50% option, suggesting that sentiment remains bearish.

He added that both himself and fellow analyst James Seyffart think it will be around 25%,

“But this is not something I’d be[t] a sushi lunch over, too many unknowns.”

According to its website, the Grayscale Bitcoin Trust holds 536,694 BTC worth an estimated $21.3 billion. So, it is unlikely that the selling is over yet.

Nevertheless, a lower BTC price will be good news for the other ETF issuers and investors waiting to buy the dip.

Acquisition Potential

ETF Store president Nate Geraci commented:

“A strategic acquisition of a firm such as Grayscale makes a ton of sense for the right traditional ETF issuer assuming the price is palatable.”

Seyffart backed the notion that a larger player could acquire the crypto asset manager:

“Someone acquiring Grayscale is theoretically possible, possibly even likely over a long enough time frame, particularly with the current issues surrounding their parent company.”

Meanwhile, Bitcoin prices had lost $40,000 again. They were down 0.8% on the day at $39,710 at the time of writing.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.