Hyped GameFi Project DeFi Kingdoms Down 90% Amid Unlock Exploit

Key Takeaways

DeFi Kingdoms’ JEWEL token is down more than 90% from its January all-time highs.

A recent exploit impacting the speed at which players can unlock their locked JEWEL has also affected the token’s price.

Although a patch for the exploit is set to go live later today, JEWEL is not showing any signs of recovery.

Share this article

DeFi Kingdom’s JEWEL token price has plummeted more than 90% as interest in the game wanes. A recent exploit that allows players to mine locked JEWEL from multiple accounts has further impacted the price of the token.

DeFi Kingdoms Down

Another play-to-earn game is struggling to balance its economy.

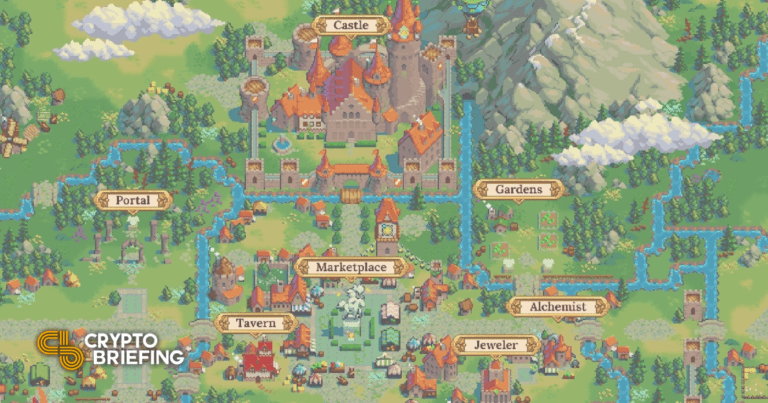

GameFi project DeFi Kingdoms has seen the price of its JEWEL currency token retreat more than 90% from its January all-time highs. The generous JEWEL rewards given to players have created increased sell pressure without an influx of new players to balance the game’s economy.

Additionally, a recent exploit impacting the speed at which players can unlock their locked JEWEL has also affected the token’s price. According to DeFi Kingdoms developer Frisky Fox, mining locked JEWEL can be “unfairly augmented” by transferring it between multiple accounts, allowing more Heroes than intended to mine the locked JEWEL simultaneously.

While the exploit has only resulted in a small amount of extra JEWEL entering the market compared to the amounts mined legitimately, the price of JEWEL has still been hit hard. In the past 24 hours, JEWEL has fallen another 21%, to a local low of $2.25. Just four months prior, JEWEL was trading at an all-time high of $22.52. Although a patch for the exploit is set to go live later today, JEWEL is not showing any signs of breaking its months-long downtrend.

According to data from DappRadar, the number of active DeFi Kingdoms players has halved over the past month, declining from 30,000 on Mar. 31 to approximately 15,000 today. The number of transactions and transaction volume has similarly decreased. DeFi Kingdoms is not alone in this respect; several other play-to-earn games such as Axie Infinity and Crabada have also suffered an exodus of players and activity in recent months.

At its height, DeFi Kingdoms had solidified its place as a top blockchain game. Crypto influencers such as Ansem regularly expressed their bullish outlook on the game, while the Crystalvale expansion fueled hype to euphoric levels. However, despite a dedicated developer team and the game’s recent launch on an Avalanche subnet, DeFi Kingdoms has not fared well in the declining crypto market. Whether the game will be able to recapture its player base in the future remains uncertain.

Disclosure: At the time of writing this piece, the author owned ETH and several other cryptocurrencies.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.